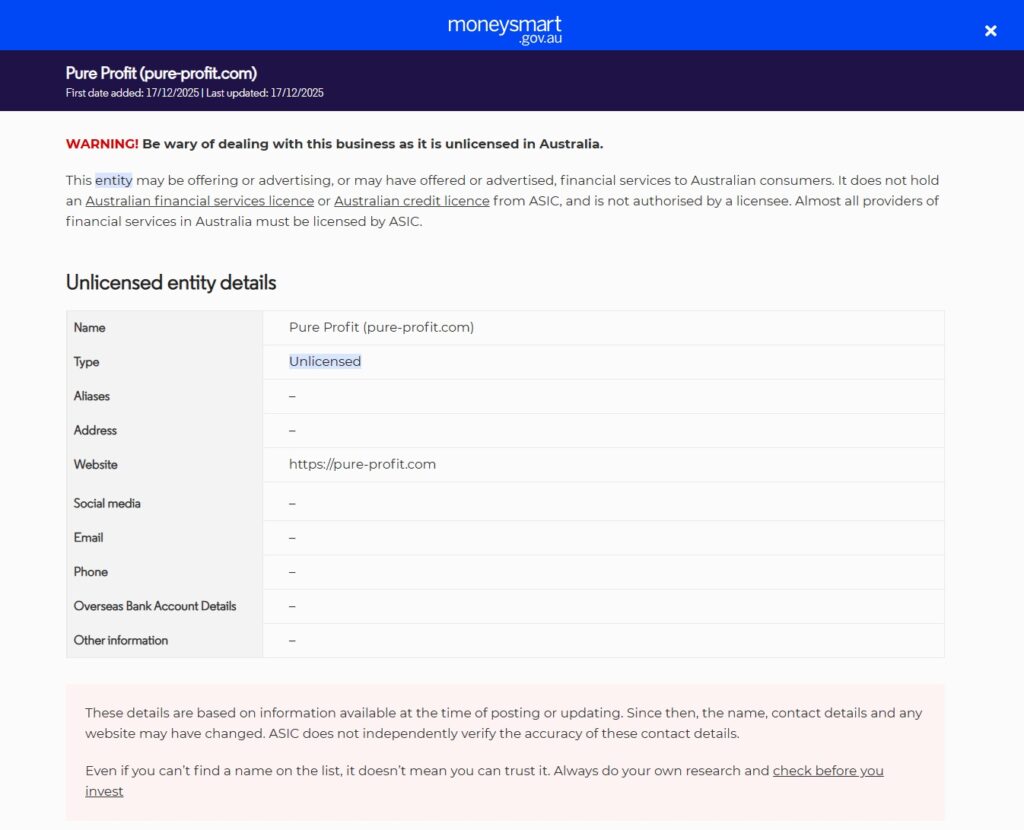

Warning – Australia’s regulator, ASIC has reported Pure Profit

Pure Profit Broker

Pure Profit (pure-profit.com) has caught the attention of both users and regulators. This Pure Profit review analyzes who pure-profit.com claims to be, the services it offers, its regulatory status, common red flags, and actions to take if you lose money.

About Pure Profit (pure-profit.com)

Pure Profit has received a serious warning from Australia’s financial regulator, the Australian Securities and Investments Commission (ASIC), stating that the company may be offering financial services without proper authorization. This means users receive no regulatory protection, making pure-profit.com a high-risk platform that shows strong scam warning signs.

Key Points from the ASIC Warning (as of Dec 17, 2025):

- Unauthorized Firm: ASIC has warned that Pure Profit is not licensed to provide financial or investment services in Australia.

- Unregulated Operation: The company is not regulated by any recognized financial authority worldwide.

- No Consumer Protection: Investors are not covered by compensation schemes or official complaint bodies.

- Website Not Working: The official website (pure-profit.com) is currently inactive, which is a major red flag.

- Lack of Transparency: Pure Profit fails to publish basic information such as a valid office address or regulatory license.

Why Pure Profit Is Considered a Scam:

- False Trust Claims: The company claims to be reliable but provides no proof of authorization.

- Regulatory Alert: ASIC warnings are typically issued when there is a high risk to consumers.

- Hidden Identity: The absence of company details makes accountability nearly impossible.

What This Means for You:

- Avoid pure-profit.com completely.

- High Risk of Financial Loss: Once funds are deposited, recovery is unlikely due to the lack of regulation.

In summary, pure-profit.com is unregulated, officially warned by ASIC, lacks transparency, and should be avoided to protect your money.

Lost Funds to pure-profit.com?

If you have lost funds to Pure Profit, take action now. Fill out a form to ask for a case review and get fund-recovery assistance.

Warning Signs Associated with pure-profit.com

- Absence of a valid, verifiable license number.

- The company address and contact information are either nonexistent or hard to trace.

- The application of forceful sales strategies is pushing for large deposits very quickly.

- The claim of “guaranteed profits” is not credible.

- The online reviews speak of payments being stopped, support disappearing, or staff being unresponsive.

What to Do If You Have Invested with pure-profit.com

Should you have already deposited money with pure-profit.com and suspect problems, do the following steps right away:

- Stop all communication with the platform and the representative that is connected to it.

- Let your bank or payment processor know about it – inquire about charge-backs, blocking more payments, or recovering funds.

- Collect proof – keep all communication, screenshots of the trading platform, deposit slips, chat logs, email threads, and transaction IDs.

- Inform the authorities – reach out to your local police or cybercrime department and lodge a formal complaint. Also, inform the financial regulator that is relevant to your jurisdiction.

- Get professional help for the recovery – if the losses are considerable, consider very carefully reliable fund-recovery or legal assistance (check credentials, fees, and past cases before hiring).

Quick Summary

Pure Profit lack of regulatory oversight, along with the multitude of red flags, makes it a high-risk market. If you decide to go on, it is imperative to check its license, corporate identity, and withdrawal history first.

For more updates, follow us on:

No responses yet