Nexcorel Holdings Capital Broker

Nexcorel Holdings Capital, operating through nexcorelholdingscapital.com, has raised serious concerns after being linked to warnings from the Australian Securities and Investments Commission (ASIC). The platform presents itself as an investment service offering high-return opportunities, but shows no verifiable regulatory registration. Experts warn that such websites often mimic legitimate firms to mislead investors. Red flags include lack of transparency, unrealistic profit promises, and aggressive marketing tactics. Authorities advise the public to verify licensing, check official investor warning lists, and avoid sharing personal or financial information with unverified platforms.

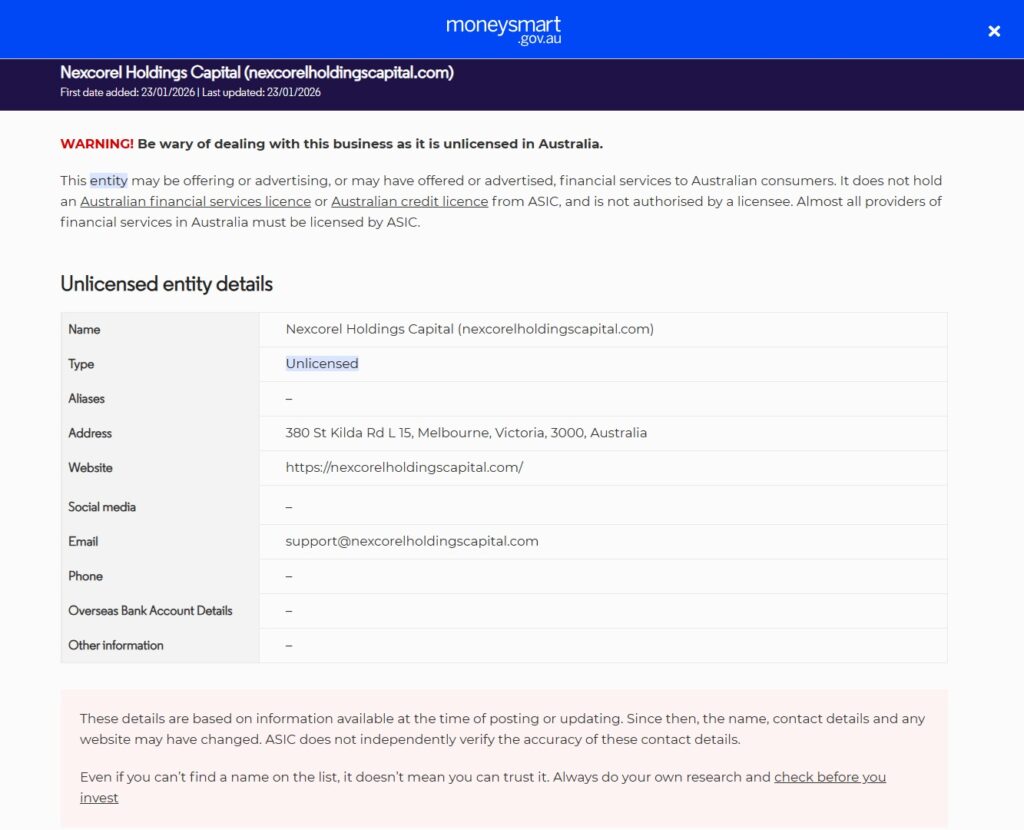

About Nexcorel Holdings Capital (nexcorelholdingscapital.com)

Website: https://nexcorelholdingscapital.com/

Address: 380 St Kilda Rd L 15, Melbourne, Victoria, 3000, Australia

Regulation Status: Unregulated

Operating Since: 2026-01-16

Lost Funds to Nexcorel Holdings Capital?

If you have lost funds to nexcorelholdingscapital.com, take action now. Fill out a form to ask for a case review and get fund-recovery assistance.

Is Nexcorel Holdings Capital a Trustworthy Platform?

To figure out if nexcorelholdingscapital.com is trustworthy, consider the following points:

- Does the broker have a valid license from a top regulator (FCA, ASIC, CySEC, etc.)?

- Does the website have verifiable company registration information?

- The phone numbers, office addresses, and legal documents are real and can be traced.

- Are customer testimonials similar, or do a lot of users say that there are problems with the withdrawal?

Conclusion:

- With the lack of proper licensing or company information, the risk might be much higher. Always check before you deposit any funds.

How Risky Platforms Often Operate

Here are the suspicious trading platforms’ tactics that are used the most:

“Pig-Butchering” / Long-Term Manipulation

Scammers first build a connection through chat apps, social media, or dating sites and then lead the unaware to trading on platforms where they are eventually ripped off.

Clone Trading Platforms

Such platforms imitate real trading platforms — showing rising balances, charts moving favourably — but these are fake. Withdrawals may be allowed initially, then blocked later.

Other Indicators

- Calls or messages urging you to make large deposits.

- Assurances of very high returns with no risks and short waiting times.

- Requests for “taxes” or “clearance fees” to be paid before the cash-out can be processed.

- A website that looks perfect, but in reality, it just hides the lack of regulatory disclosure.

- Fake user reviews, getting celebrity endorsements, or buying reviews to create an illusion of credibility.

Warning Signs Associated with Nexcorel Holdings Capital

- Absence of a valid, verifiable license number.

- The company address and contact information are either nonexistent or hard to trace.

- The application of forceful sales strategies is pushing for large deposits very quickly.

- The claim of “guaranteed profits” is not credible.

- The online reviews speak of payments being stopped, support disappearing, or staff being unresponsive.

What to Do If You Have Invested with Nexcorel Holdings Capital

Should you have already deposited money with nexcorelholdingscapital.com and suspect problems, do the following steps right away:

- Stop all communication with the platform and the representative that is connected to it.

- Let your bank or payment processor know about it – inquire about charge-backs, blocking more payments, or recovering funds.

- Collect proof – keep all communication, screenshots of the trading platform, deposit slips, chat logs, email threads, and transaction IDs.

- Inform the authorities – reach out to your local police or cybercrime department and lodge a formal complaint. Also, inform the financial regulator that is relevant to your jurisdiction.

- Get professional help for the recovery – if the losses are considerable, consider very carefully reliable fund-recovery or legal assistance (check credentials, fees, and past cases before hiring).

Quick Summary

Nexcorel Holdings Capital lack of regulatory oversight, along with the multitude of red flags, makes it a high-risk market. If you decide to go on, it is imperative to check its license, corporate identity, and withdrawal history first.

For more updates, follow us on:

No responses yet