Summary

Several financial authorities and regulators, including the Financial Services and Markets Authority (FSMA) in Belgium and the Financial Conduct Authority (FCA) in the UK, have warned Finstera, an illegal and dishonest trading platform. As a result, Finstera lacks regulatory approval to operate, and investors who use the website have no legal options if they suffer a loss. Public warnings suggest that Finstera follows the usual online investment fraud scheme – small deposits, false profits, coercion, blocked withdrawals, or money vanishes.

Regulatory Warnings Against Finstera

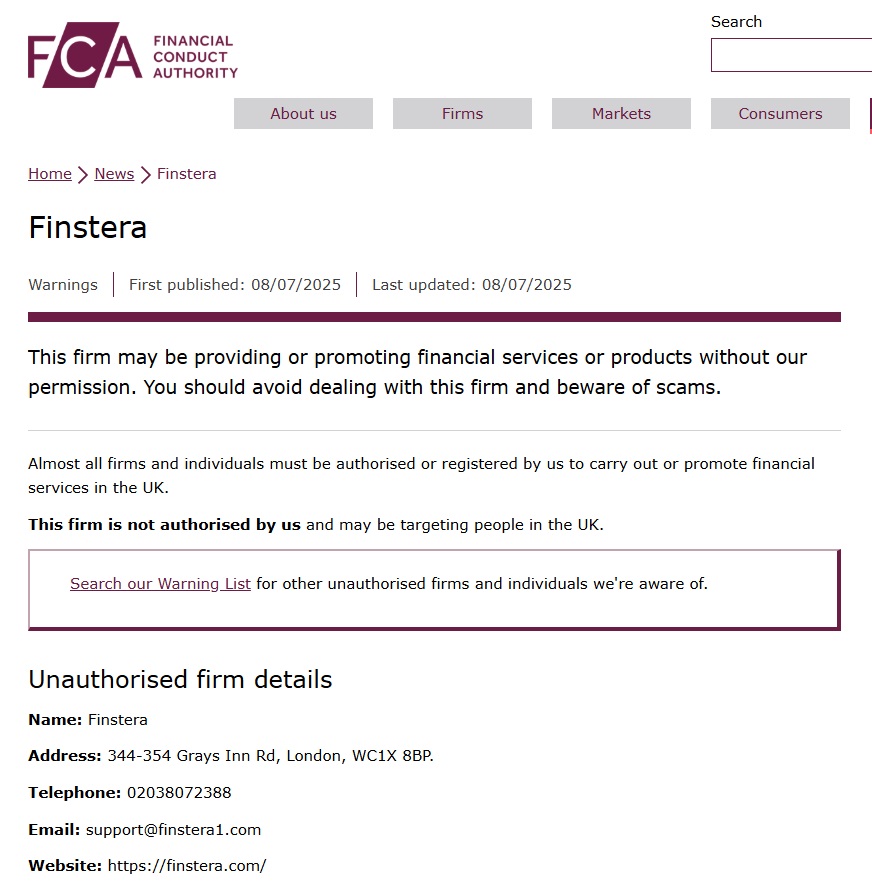

1. FCA Warning

In July 2025, FCA put out its own warning that Finstera is an unauthorized firm “targeting people in the UK.”

This indicates that Finstera does not have any valid financial or investment license to operate in the UK. Because the platform operated outside of UK law and consumer protection, the FCA advised users to stay away from it completely.

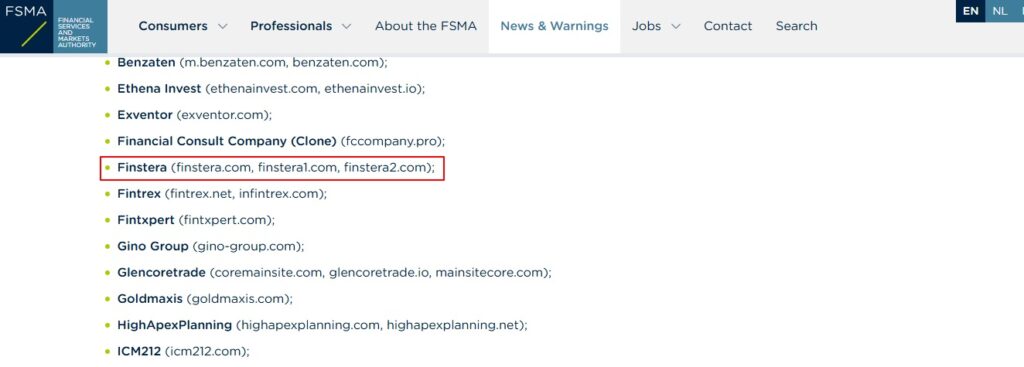

2. FSMA Warning

Additionally, Finstera received a warning from the Belgian Financial Services and Markets Authority (FSMA) for lacking sufficient authorization to provide investment products or services. The FSMA alerted investors to high-pressure sales tactics and false promises of high returns, which are indicated to be involved in online investment fraud.

How Investment Scams Like Finstera Typically Work?

Financial regulators and consumer protection organizations have recognized a common behavioral pattern shared by trading platforms that are unregulated, like Finstera. Here is an outline of their usual tactics:

1. Initial Small Deposits

Initially, Small Deposits Scammers largely convince victims to make an initial small deposit (say €250) to “try out” the platform. They often take an active role in demonstrating and appearing “helpful” and “professional”, so as not to raise suspicion.

2. Fake Profits and Manipulation

False Profits and Manipulation. After the funds are placed on the platform, the trader’s interface may display fictitious profits, or “trading,” so that the user believes they are making real returns. Scammers will often request to have remote access to the victim’s device, and then have full control over their accounts online.

3. Pressure for More Investment

After experiencing what they believed to be profits, victims are pressured to invest even larger amounts. Callers acting as “account managers” will often use emotional techniques or urgency to get the victims to send even more money.

4. Withholding Large Withdrawals

First, minor withdrawals may be permitted to instill confidence, but as soon as the victim attempts to withdraw a significant amount, the excuses start to alter depending on the withdrawal amount being requested, which can include “verification,” “tax fee,” “system error,” or the exchange going offline.

5. Platform Disappears

Eventually, it is either the website crashes, or the victim cannot access their funds through their account forever.

What To Do If You’ve Lost Money to Finstera

If you sent money to Finstera or any of the similar platforms, follow this advice:

- Stop replying to the business right away.

- Inform the consumer protection or your financial authority.

- Reach out to agents who specialize in recovery for unauthorized brokers.

FAQs

1. Is Finstera a regulated trading platform?

No. Finstera is not regulated or authorized by any well-known financial regulator, and there are official warnings about it from both the FCA (UK) and FSMA (Belgium).

2. Can I get my money back from Finstera?

Possibly, but it would highly depend on how you paid and how soon you act. Professional assistance from fund recovery specialists can help in tracing your funds and recovering your money.

3. How can I check if a trading company is authorized?

You can check if a company is regulated by searching for its name on regulatory bodies’ websites (e.g., FCA Register or ESMA database) before investing.

Need Help Recovering Your Funds?

If you have fallen victim to Finstera or any other unauthorized trading platform, go to TruClaim to report your case and receive expert assistance in recovering funds you have lost.

For more updates, follow us on:

No responses yet