Banking Circle is a high-risk financial service provider. Caution is advised.

Website: https://www.bankingcircle.com/

Regulation: No verified forex regulation

Guaranteed funds: No

Segregated accounts: Not clearly disclosed

Trading software: None

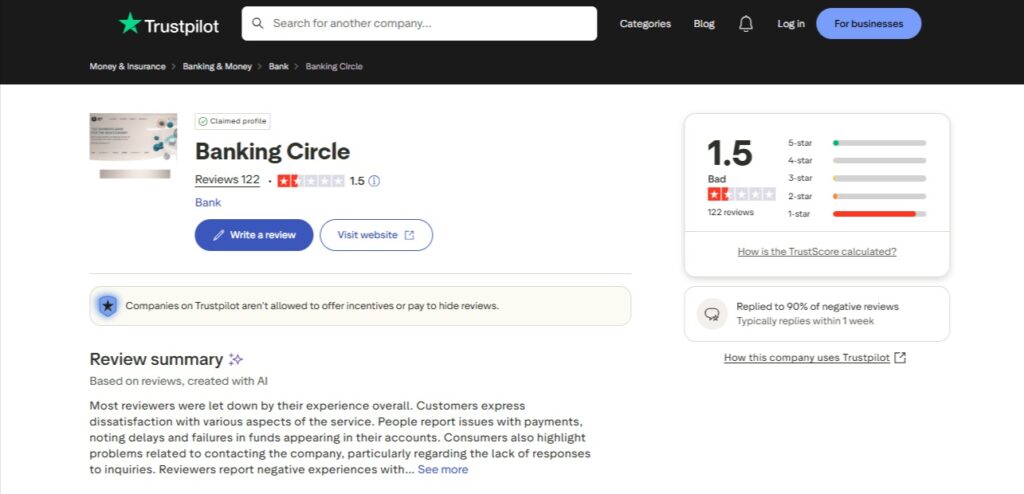

WikiFX score: 1.50/10 (Danger)

Banking Circle presents itself as a global payments bank offering fast, low-cost international payments through advanced API-based infrastructure. According to its website, the company serves payment businesses, banks, and marketplaces by connecting them to major clearing systems worldwide. On paper, this sounds professional and well-established. However, when we closely examine the available information, there are serious inconsistencies and red flags that everyday users should be aware of.

Regulation and safety of funds

One of the most important questions people ask is: Is Banking Circle regulated? The answer is unclear—and that is a problem.

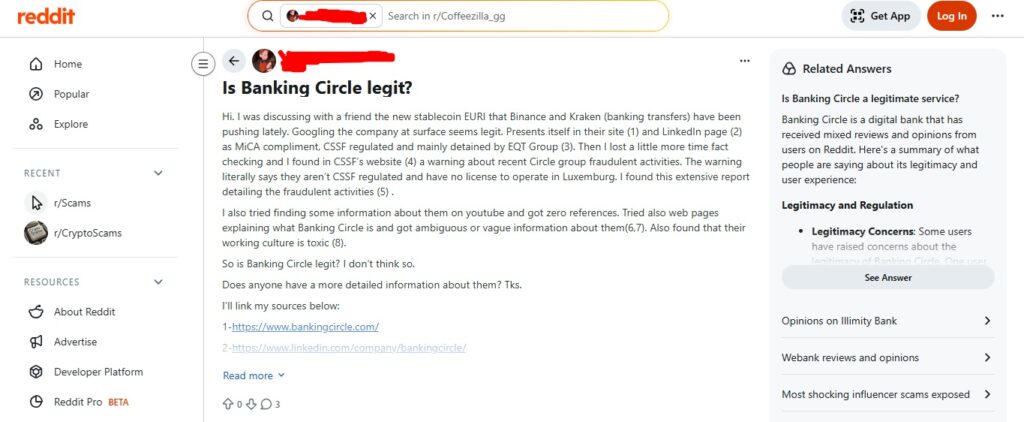

Banking Circle claims on its official website that it has been authorized as a credit institution under EU Regulation (EU) No 575/2013 and that it is supervised by the Luxembourg Commission for the Financial Sector (CSSF). However, independent checks and user reports suggest a different story. There are warnings indicating that Banking Circle is not properly regulated for certain financial activities, and some sources claim it does not hold the required license to operate in Luxembourg.

This lack of clear, verifiable regulation is a major concern. Regulated financial institutions must follow strict rules to protect client funds, maintain transparency, and remain accountable. When regulation cannot be independently confirmed, users face higher risks, including frozen funds or unresolved disputes.

No trading platform and broker warning

WikiFX has issued a danger rating of 1.50/10 for Banking Circle. According to WikiFX, this entity lacks valid forex regulation and does not provide any trading software. This is important because some users may mistakenly assume Banking Circle operates like a traditional broker. It does not. The absence of trading software and broker licensing raises questions about how and where funds are actually handled.

Services and business claims

Banking Circle states that it processed over €250 billion in payment volume in 2021 and supports more than 250 regulated businesses, including well-known names such as Ixaris, Nuvei, and Paysafe. It also mentions being acquired by EQT VIII and EQT Ventures in 2018 and having offices in Luxembourg, London, Copenhagen, and Munich.

While these claims sound impressive, big numbers and well-known names do not replace regulation. Even large financial operations must be properly licensed for the services they offer. Without transparent oversight, users are left relying solely on the company’s own statements.

User complaints and public concerns

Online feedback paints a worrying picture. Banking Circle holds a Trustpilot rating of 1.5, with 88% of negative reviews, many of which mention poor support, account issues, and lack of clarity.

A Reddit discussion also raises serious concerns. Users reported finding a CSSF warning suggesting that certain Circle-related entities were not regulated and not authorized to operate in Luxembourg. Others mentioned vague information online, lack of independent reviews, and even reports of a toxic internal work culture. These are not signs of a transparent, trustworthy financial service provider.

Final verdict: Is Banking Circle safe?

Based on the low WikiFX score, unclear regulatory status, lack of trading software, and a large number of negative user reviews, Banking Circle appears to carry significant risk. This does not automatically mean every service is fraudulent, but it does mean users should proceed with extreme caution and avoid placing funds they cannot afford to lose.

What to do if you’re facing issues

If you have already used Banking Circle and are experiencing problems such as frozen funds, unclear charges, or unanswered support requests, it’s important to act quickly. Visit Truclaim.tech to explore guidance options and understand possible next steps for resolving financial disputes or recovering funds.

Take action now. Fill out a form to ask for a case review and get fund-recovery assistance.

Always verify regulation independently. When transparency is missing, the risk is real.

For more updates, follow us on:

No responses yet