RoboForex is an offshore broker. Your money may not be safe.

Website: http://www.roboforex.com/

Regulation: Offshore only

Guaranteed funds: No

Segregated accounts: Not clearly disclosed

Trading platforms: MT4, MT5, proprietary platforms

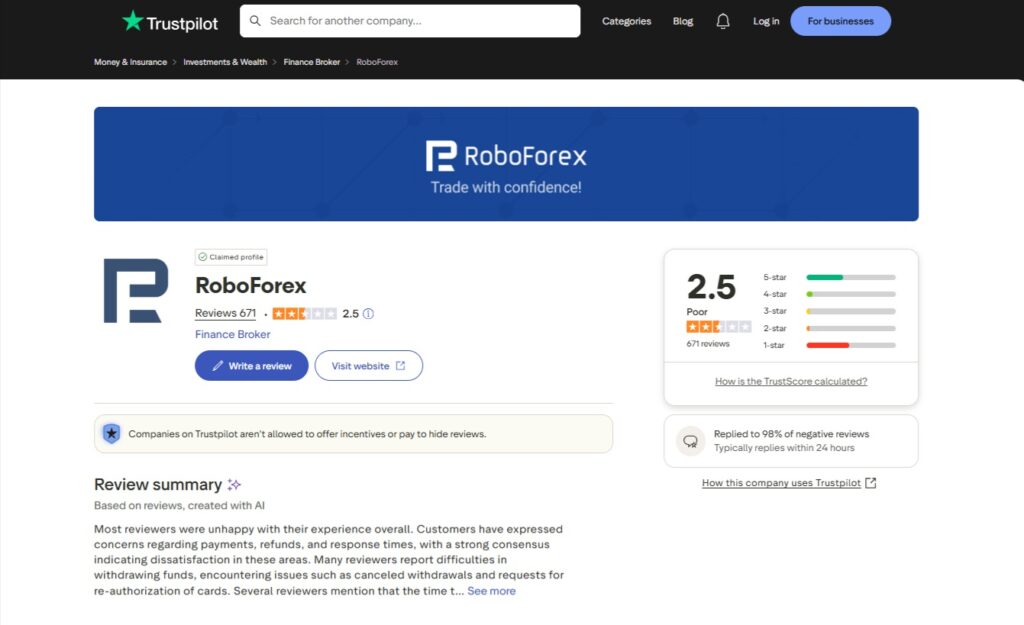

WikiFX score: 2.50/10 (Danger)

RoboForex is a forex and CFD broker that was founded in 2009 and is operated by RoboForex Ltd, which is registered in Belize. Over the years, the company has promoted itself as a well-established broker offering access to a very large number of trading instruments, including forex pairs, stocks, indices, ETFs, commodities, metals, and energies. While RoboForex may appear experienced and feature-rich at first glance, a closer review reveals several risks that everyday traders should clearly understand.

Regulation and safety of funds

The most important question is simple: Is RoboForex properly regulated? The answer depends on how much risk you are willing to accept.

RoboForex Ltd is authorized by the Financial Services Commission (FSC) of Belize, which is considered an offshore regulator. Offshore regulation does not provide the same level of investor protection as top-tier regulators such as the FCA (UK), ASIC (Australia), or CySEC (EU). There are no strong compensation schemes or strict enforcement mechanisms in place.

WikiFX has issued a danger rating of 2.50/10 for RoboForex and reports 35 user complaints along with multiple negative field survey reviews. These are clear warning signs that should not be ignored. Traders should also note that RoboForex does not target EU, EEA, or UK clients, and services are offered at the trader’s own initiative, meaning all risks are borne by the user.

Regional restrictions and limitations

RoboForex does not operate in several major regions, including the USA, Canada, Japan, Australia, Iran, Russia, and other restricted countries. This limited market access further highlights regulatory constraints and reduces confidence for international traders.

Another point to consider is RoboForex’s withdrawal policy. While the broker offers free withdrawals, they are limited to three times per month, which may be inconvenient for active traders who want flexible access to their funds.

Trading platforms and instruments

RoboForex does offer a wide range of platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are popular and reliable trading tools. These platforms support advanced charting, automated trading, and mobile access.

In addition, RoboForex provides proprietary platforms such as WebTrader, MobileTrader, and R StocksTrader. While platform variety is a positive feature, it does not compensate for weaker regulation or user complaints related to withdrawals and fund safety.

User reviews and complaints

RoboForex has a Trustpilot rating of 2.5 (Poor) based on over 670 reviews, with nearly 48% being negative. Many users complain about withdrawal delays, account issues, and poor customer support.

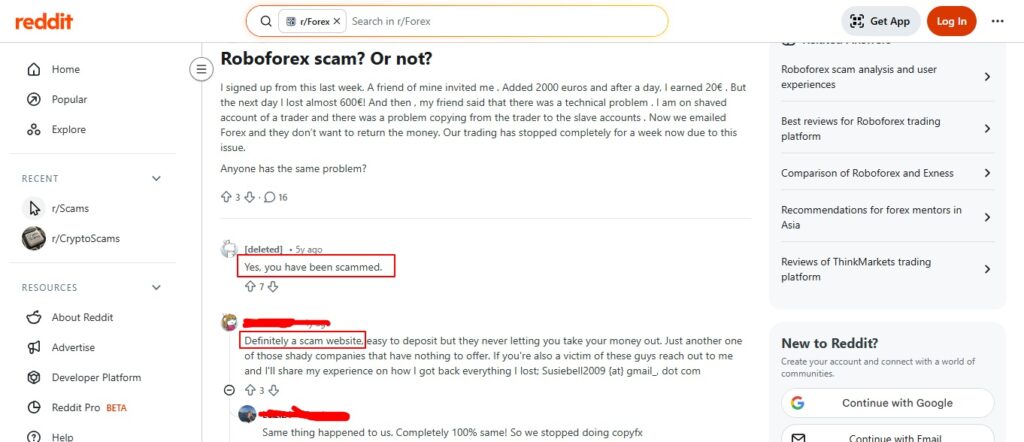

A Reddit comment describes RoboForex as “easy to deposit but difficult to withdraw,” which is a recurring complaint often seen with high-risk or offshore brokers. While not every trader will have the same experience, repeated reports of withdrawal problems are a serious red flag.

Final verdict: Is RoboForex safe?

RoboForex offers many trading instruments and platforms, but the risks are significant. Offshore regulation, a low WikiFX score, numerous complaints, and poor user reviews suggest that RoboForex is not a low-risk broker. Traders should be extremely cautious and avoid depositing funds they cannot afford to lose.

What to do if you’ve lost money

If you have already traded with RoboForex and are facing withdrawal issues or account problems, do not ignore the situation. Visit Truclaim.tech to explore guidance options and understand possible next steps for handling broker disputes or potential fund recovery.

Take action now. Fill out a form to ask for a case review and get fund-recovery assistance.

Final takeaway: Strong platforms do not guarantee safety. Regulation and transparency matter most when your money is on the line.

For more updates, follow us on:

No responses yet