Digital FX Trading Broker

Digitalfxtrading.com has caught the attention of both users and regulators. This Digital FX Trading review analyzes who Digital FX Trading claims to be, the services it offers, its regulatory status, common red flags, and actions to take if you lose money.

About Digital FX Trading (Digitalfxtrading.com)

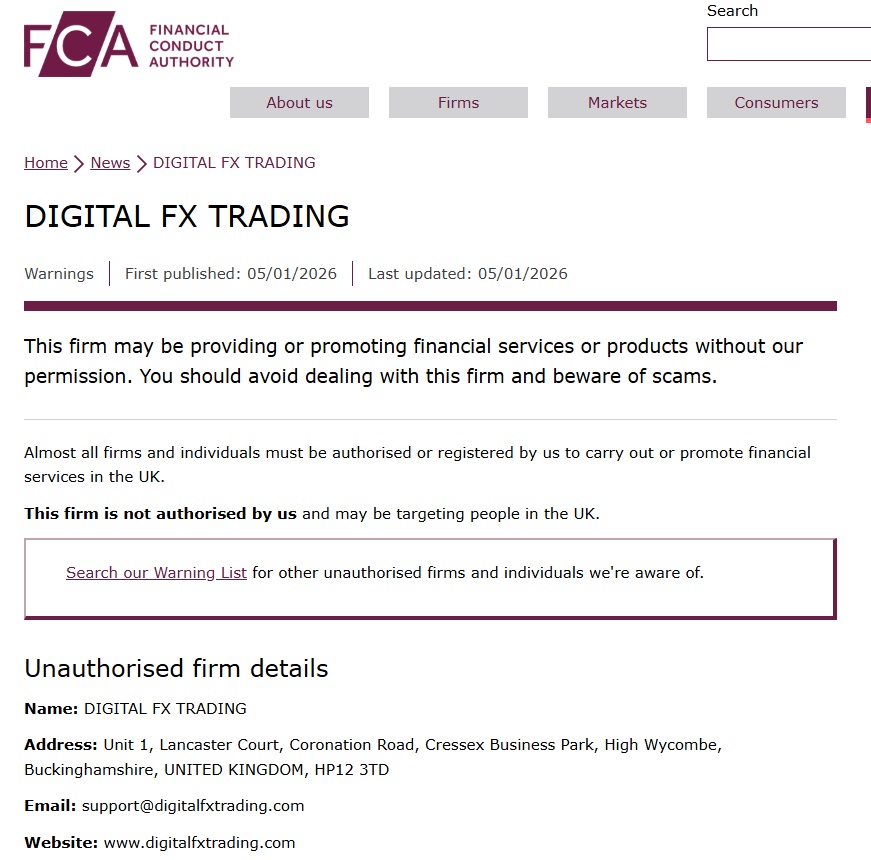

Warning – The United Kingdom’s regulator, the Financial Conduct Authority, has reported Digital FX Trading

Website: https://digitalfxtrading.com/

Address: Unit 1, Lancaster Court, Coronation Road, Cressex Business Park, High Wycombe, Buckinghamshire, UNITED KINGDOM, HP12 3TD

Regulation Status: Unregulated

Operating Since: 2025-05-22

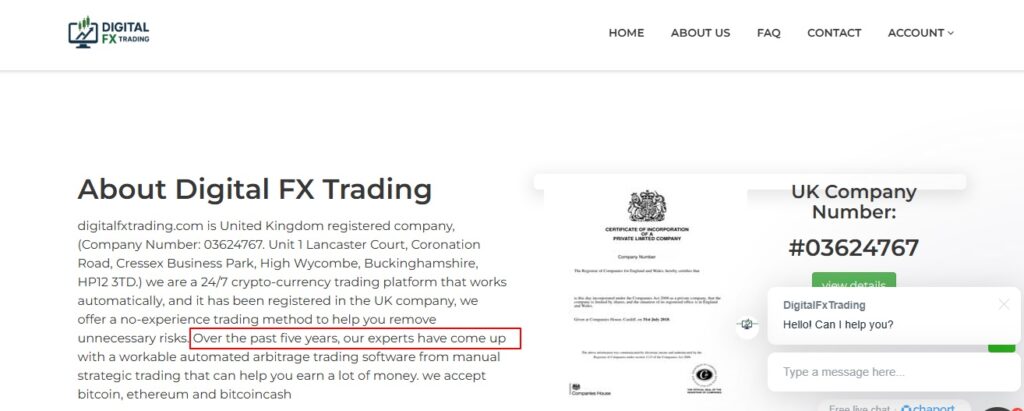

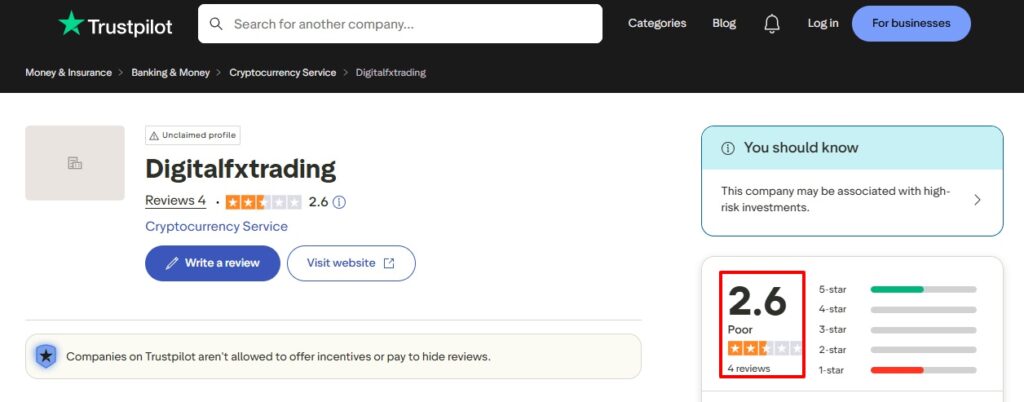

Digital FX Trading states that it is registered/licensed as per the information on its website, claiming to be based in the UK (Company No. 03624767) and located in High Wycombe. Digital FX Trading provides account management services and investment advice. It claims that it has developed an automated Arbitrage Trading System (ATS) that works with cryptocurrencies, and it has developed this over the past five years. The website DigitalFXTrading.com was not registered until 2025. Digital FX Trading has a Trustpilot score of approximately 2.6 with many negative reviews. Digital FX Trading has also been warned by the FCA in the UK, which makes this company highly questionable and raises concerns about regulatory compliance/credibility.

Lost Funds to Digital FX Trading?

If you have lost funds to Digital FX Trading, take action now. Fill out a form to ask for a case review and get fund-recovery assistance.

Is Digital FX Trading a Trustworthy Platform?

To figure out if Digital FX Trading is trustworthy, consider the following points:

- Does the broker have a valid license from a top regulator (FCA, ASIC, CySEC, etc.)?

- Does the website have verifiable company registration information?

- The phone numbers, office addresses, and legal documents are real and can be traced.

- Are customer testimonials similar, or do a lot of users say that there are problems with the withdrawal?

Conclusion:

- With the lack of proper licensing or company information, the risk might be much higher. Always check before you deposit any funds.

How Risky Platforms Often Operate

Here are the suspicious trading platforms’ tactics that are used the most:

“Pig-Butchering” / Long-Term Manipulation

Scammers first build a connection through chat apps, social media, or dating sites and then lead the unaware to trading on platforms where they are eventually ripped off.

Clone Trading Platforms

Such platforms imitate real trading platforms — showing rising balances, charts moving favourably — but these are fake. Withdrawals may be allowed initially, then blocked later.

Other Indicators

- Calls or messages urging you to make large deposits.

- Assurances of very high returns with no risks and short waiting times.

- Requests for “taxes” or “clearance fees” to be paid before the cash-out can be processed.

- A website that looks perfect, but in reality, it just hides the lack of regulatory disclosure.

- Fake user reviews, getting celebrity endorsements, or buying reviews to create an illusion of credibility.

Warning Signs Associated with Digital FX Trading

- Absence of a valid, verifiable license number.

- The company address and contact information are either nonexistent or hard to trace.

- The application of forceful sales strategies is pushing for large deposits very quickly.

- The claim of “guaranteed profits” is not credible.

- The online reviews speak of payments being stopped, support disappearing, or staff being unresponsive.

What to Do If You Have Invested with Digital FX Trading

Should you have already deposited money with Digital FX Trading and suspect problems, do the following steps right away:

- Stop all communication with the platform and the representative that is connected to it.

- Let your bank or payment processor know about it – inquire about charge-backs, blocking more payments, or recovering funds.

- Collect proof – keep all communication, screenshots of the trading platform, deposit slips, chat logs, email threads, and transaction IDs.

- Inform the authorities – reach out to your local police or cybercrime department and lodge a formal complaint. Also, inform the financial regulator that is relevant to your jurisdiction.

- Get professional help for the recovery – if the losses are considerable, consider very carefully reliable fund-recovery or legal assistance (check credentials, fees, and past cases before hiring).

Quick Summary

Digital FX Trading lack of regulatory oversight, along with the multitude of red flags, makes it a high-risk market. If you decide to go on, it is imperative to check its license, corporate identity, and withdrawal history first.

For more updates, follow us on:

No responses yet